car insurance money liability perks

car insurance money liability perks

credit score auto vehicle insurance car

credit score auto vehicle insurance car

Learn everything you require to find out about the top 10 variables that influence cars and truck insurance policy prices the most - car., Vehicle Insurance policy Moderator, Apr 11, 2022.

The is an aspect that impacted the cars and truck insurance policy premium. Depending on one's, the cars and truck insurance can be lower or greater, generally higher for somebody more youthful. Therefore, the is an element that affected the cars and truck insurance policy costs. Therefore, the is correct - cheap. Raed more around

Crashes impact not only noticeable points like auto insurance coverage rates, driving records, as well as home; they likewise influence physical and also psychological health as well as one's monetary status. Age as well as Sex Premium Element, Insurance business practically constantly bill greater prices for chauffeurs in between the ages of 16 to 25 with 16-year-olds having the greatest casualty rate of any type of age. Commonly as motorists mature, rates for males and women also out though some insurance policy providers might still offer women more of a discount due to the fact that males still statistically drive extra often as well as get even more tickets.

# 3. Credit History Ranking Premium Element, Insurers often use credit report to figure out just how much to charge for costs. It is very important to not acquire any even more offenses throughout that time so your rates can once again lower as soon as the boost period finishes. # 5. Drunk Driving as well as Dui Costs Aspect, Over the past couple of decades, public recognition of the risks of driving under the influence has actually been elevated by the media and teams such as Moms Versus Driving Under The Influence (MADD). The reason for this is that the more individuals that reside in a given location, the more cars and trucks as well as congestion and also the better opportunity of having a mishap. It likewise matters whether you live in the city or a suburb. Some states have actually passed regulation where insurance companies can not charge even more due to the fact that you live in one area or another. # 7. As simple as that appears, countless vehicle drivers are caught each year driving without appropriate insurance protection. The effects of doing so are relatively clear. First and also leading, driving without insurance coverage puts you at terrific economic and also legal danger. If you enter into a crash as well as you don't have insurance, as well as you are located at-fault, you are responsible for all the sufferer's expenditures as a result Homepage of the mishap along with your own - vans. This ought to be classified under Usual Sense yet if you drive a vehicle, you need to never ever go without protection. If you permit your insurance policy to gap or merely pick not to lug a plan, you're taking a huge threat with your economic future and safety and security. # 8. Points on Certificate Premium Element, Factors on licenses are a typical as well as simple method to gauge the risk a vehicle driver poses to an insurer. There are several essential points to bear in mind when or if you are ever before examined points on your motorist's permit. Each state has their own statute of restrictions concerning when points are removed from your record. If you live in Maine, points just take one year to go away whereas In Massachusetts, they will continue to be for 6 years. You should check your DMV's web site to see just how or if you can do this. Very frequently there is a nominal fee attached. It's crucial to likewise remember that lot of times your driving record will certainly follow you from one state to another. If you move, bear in mind that lots of points you 'd rather fail to remember such as convictions, mishaps, relocating infractions, as well as

other products will be described on your driving record. # 9. The better an auto's value, the a lot more costly it is to guarantee since of the cars and truck's higher repair/replacement value makes it a better threat to the insurance provider. car. Conversely, made use of cars usually cost much less to insure and also might not also call for accident insurance coverage. As time takes place, it will earn less feeling to have also much coverage merely since the cars and truck's value is less than what it costs to guarantee - low cost. Theft Threat Insurance Coverage Costs Factor, If you reside in a high-theft location and also you have thorough protection, you're most likely to have a greater price on your policy. If you are worried about theft, you should bear in mind a pair of points. First off, your insurance coverage firm will determine your burglary insurance coverage premium based upon where you live as well as your risk of burglary. One of the most common factors

The The 11 Most Important Factors That Affect Your Car Insurance ... Statements

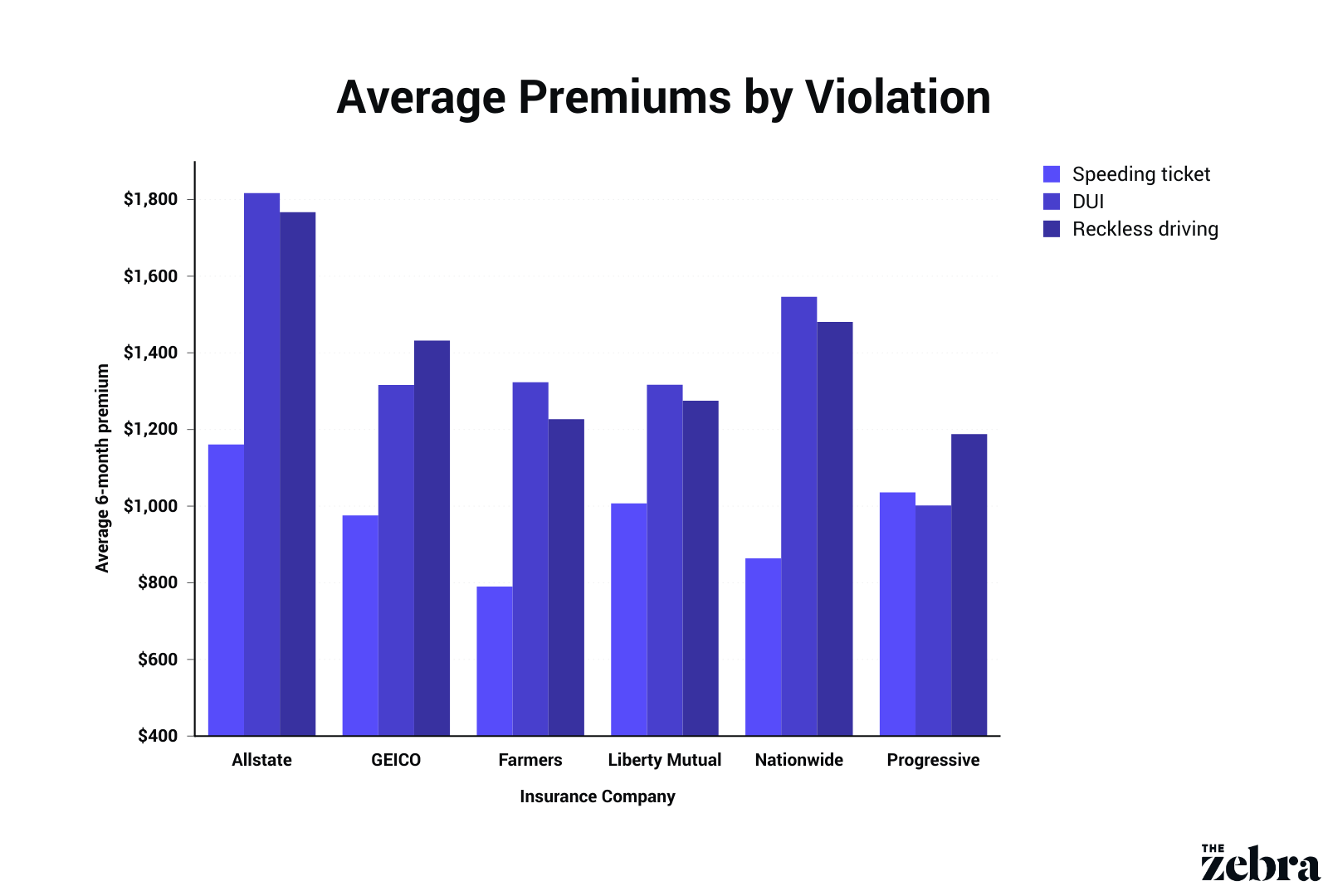

which can trigger a private to be thought about a high risk driver are as adheres to: New, unskilled drivers (grown-up or teen )Chauffeurs with various as well as constant relocating infractions, such as speeding tickets, Chauffeurs with several DUI/DWI citations/convictions, Any person convicted of reckless driving, Anyone entailed in two or even more crashes within a 1 year period, Individuals with a poor debt score/history, Persons with clinical conditions which might possibly impair their driving capacity, Males under the age of 25 as well as people over the age of 70Many times when insurance provider position an existing insurance policy holder in the high threat vehicle insurance classification they also drop their coverage and also decline them an alternate plan. Thousands of companies do offer non-standard auto insurance coverage plans, but as expected, at a much higher cost to the customer. Insurance policy companies make their very own assessments concerning a high danger driver as well as whether to use that person insurance protection. Motorists that assume they might fall under the high threat category may intend to think about calling their neighborhood Division of Motor Vehicles for even more particular information on non-standard auto insurance service providers and the state's AIARP. Be prepared to perhaps provide them permission to assess your driving record and also debt history. Details on danger factors that influence cars and truck insurance policy rates are accumulated by the insurance policy firm as you fill out a quote type (vehicle insurance). Next, behind the scenes, the business's algorithms most likely to function to make an informed hunch on your danger degree as well as compute your rate quote. The much safer you seem, the less you'll pay. Some elements made use of to set your prices, for instance your driving record, age as well as where you live, are weighed a lot more heavily than others, for instance your marriage status, Several, but not all, states enable the usage of age, sex as well as marital status in setting prices, All states yet The golden state, Hawaii, Massachusetts and Michigan allow usage of credit history in establishing insurance policy rates What are the rating aspects? Insurance coverage premiums start out with a base rate based on wide classifications of drivers, such as ladies under the age of 25 living in Tampa florida, Florida. One supplier might have less cases for your model car, as well as in turn, provide a reduced rate than another automobile insurance firm. Because of different calculations by each cars and truck insurance policy company, it's crucial to go shopping around to get the very best price. Your vehicle's insurance policy prices may raise or lower when there is a modification to any one of these danger elements. Location Insurers generally start by requesting for your postal code because where you live is the start of a lot of base rates. If you stay in a very inhabited, city area, after that blockage, crashes as well as insurance cases are extra widespread. Living and also driving in a metro area will make your prices higher

than if you stay in a backwoods, where having a vehicle accident because of these variables is much less most likely. Every one of this assists them to recognize the dangers related to insuring you and also your auto in that postal code. Not all states allow your area to be a significant score variable. For instance, California law calls for that automobile insurance coverage companies determine prices based on your driving document, yearly miles driven as well as years of experience prior to considering your geographical area. Age "The more youthful the motorist the higher the rates" might be the motto of auto insurance policy. Youthful, newbie motorists have statistically shown to be premature behind the wheel, quickly sidetracked and also to crash a lot so they are the riskiest group of motorists to guarantee. Rates reduction at different times with different insurance providers, but generally your prices can drop as much as 20 percent when you turn 25. Centers for Condition Control(CDC )mentions, the danger of being injured or killed in an automobile crash rise as you age. Right here are the states that do not allow insurance firms to price on age: The golden state( yet can rank on years of driving experience, so those with less experience might pay even more)Hawaii, Massachusetts Rhode Island does rate based upon age but has a policy to secure senior drivers. The IIHS keeps in mind that males commonly drive a lot more miles then ladies and also take part in riskier driving habits such as speeding, driving when intoxicated as well as not making use of a safety belt. The IIHS likewise located accidents including male motorists have a tendency to be a lot more extreme than women motorists. Insurance companies evaluate this details as well as rate as necessary. Sex differences in casualty risk diminish with age. When males and females enter their 30s, generally auto insurance coverage prices become comparable for both sexes with lots of insurance companies, and depending upon their own information might allow males to get slightly lower rates than females. As motorists age right into their 60s, rates for males often tend to begin to increase once again over the women as collision data once again show males of an older age crash more than women. Marital condition Wedded couples have been found statistically to be much less of a threat to insurance policy carriers than their single (including those who are divorced or widowed)equivalents. Wedded pairs have been located to be much less energetic as well as safer than solitary vehicle drivers, leading to less crashes as well as cases. A research study by the National Institute of Wellness found that single chauffeurs were twice as likely to be an auto crash as wedded drivers. Married pairs can likewise obtain discounts when they combine their policies, such as a multi-car discount rate and also a multi-policy discount rate for packing house owners or occupants policy(or other plans) and automobile insurance with the same company. States that don't permit car insurance firms to price on marital condition: Hawaii, Massachusetts, Michigan, Montana 5. How much was paid out is examined, because cases under a particular amount, such as$2,000, may keep you from a surcharge. States legislation differ on this. risks. New York does not enable an additional charge unless you're at fault as well as losses of over$2,000 or are covered of specific violations. If you've had 3 insurance claims in three years, vehicle insurance suppliers are going to see you as risky to guarantee and either hike up your rates or decide not to renew your policy at the end of the term. New York additionally enables surcharges if you have been in tow or even more mishaps within three years, even if the occurrences weren't usually surchargeable. 8. Credit rating Though it might be controversial, study has shown that those with reduced debt ratings (usually under 600) are more probable to file even more insurance claims, data pumped up claims, and also devote insurance coverage fraudulence. You'll likely see a walking in your premiums as a result of a low credit rating. Consumers aren't keen on this method, and also a couple of states forbid insurance providers from utilizing credit rating as a variable.

Because stats have actually shown that customers with low credit report are most likely to miss out on a repayment, insurance firms may ask you to pay a large portion of the policy in advance. Consumers with extremely inadequate credit score ratings might be needed to pay the whole six-or 12-month premium upfront in order for the policy to be issued. insurers.

trucks cheaper cheaper cheapest

trucks cheaper cheaper cheapest

Thus, in North Carolina having an exceptional credit rating score must lead to a discount off your base rate - vehicle insurance. 9. Previous insurance policy protection Insurance provider locate that those without a lapse in protection are less likely to enter into a crash, so having a continuous vehicle insurance coverage history can assist obtain you a far better price. If you were on your parent's plan formerly, allow your new insurance company know so it will not appear that you were without prior coverage when requesting your initial private plan. Having a lapse in coverage even simply a day can result not only in higher car insurance prices, but also get you penalized by some states. For a stored cars and truck, you can see concerning decreasing coverage to perhaps simply comprehensive(if you do not have a lienholder), yet still keep the automobile plan energetic

The 9-Minute Rule for Which Affects One's Car Insurance Premium At Cars - Contra Costa ...

10. Automobile kind The sort of car you drive affects your prices since the means in which one drives these kinds of automobiles differs. A couple of have actually started to distribute discounts for sophisticated safety attributes. 11. Use of vehicle Insurers additionally wish to know why you're driving your cars and truck. A car made use of to commute to institution or job presents even more of a risk than the automobile you only take out of the garage when a week. Rate quotes can vary by numerous bucks or more. Make every effort to keep insurance provider delighted by presenting less of a threat with the ranking elements you can regulate, and consequently, your purse will be happier, too. Associated Articles. Various other aspects can change exactly how much you pay. House owners insurance coverage differs from person to.

person due to the fact that there are several personal aspects utilized to determine residence insurance policy rates. Marital condition, debt background and also even your dog's breed could impact the amount you pay in costs. Comprehending what insurance firms make use of to determine your prices is valuable as you are navigating via the various choices for property owner insurance firms and also protection alternatives. In comparison, replacement costs only refer to the expenditure of restoring a house after a loss. Credit rating, Like bank lending institutions, numerous insurance companies examine home owners'credit scores in assessing the level of threat they are taking on. An excellent credit rating might result in being viewed as reduced risk as well as prices are typically reduced accordingly. Insurance firms feel property owners with inadequate credit scores are extra most likely to file claims under their policy than are property owners that have very great credit history."Many insurance providers use credit score as a section of the rate-setting process in states where it is allowed,

"claimed P.J. vans. Miller, companion as well as independent insurance policy representative with Wallace & Turner Insurance in Springfield, Ohio. vehicle insurance. When a home owner sues, the home owners insurance policy business assumes he or she is more probable to file added cases

in the future. A history of submitting a number of insurance claims might suggest an also greater threat for the insurance provider - perks. Miller took place to explain exactly how the kind and also number of claims you make can affect prices. Likely to see lower rates Single Greater than typical Solitary individuals file even more cases. This group is also perceived as being much less accountable as well as much more most likely to take risks (liability). Likely to see higher rates Age of home, If you stay in an older residence or one that would likely require a whole lot of renovations if rebuilt, you will likely pay a higher residence insurance premium. Accepting a higher deductible will decrease your premium, however it might additionally cost you extra in the event of a claim."Lots of insurance providers likewise offer vanishing deductibles, which indicates they minimize your deductible if you don't have any kind of insurance claims over a particular period, "Miller said.

Some Known Factual Statements About Does Private Information Influence Automobile Insurance ...

Location, The area of your residence influences the quantity you pay in costs. Nevertheless, location might have a positive influence also, if you lie near a staffed fire station as an example. Area is also made use of to figure out the replacement costs, considering that building and construction prices, consisting of labor and materials, can vary depending upon the neighborhood. Shocking aspects that influence your home insurance rate, Though the variables above connecting to a home's construction, background and the insured's economic background are significant, there are lots of various other variables thought about in setting prices, which are typically forgotten. Both the type of residence and also the amount of security you want are driving aspects for which house insurance coverage to select.

Frequently asked inquiries, What is the finest property owners insurance coverage business,

Similarly, likewise numerous just how countless variables home insurance residenceInsurance policy prices are several points to consider for take into consideration the figuring out homeowners ideal property ownersInsurance policy Should I lower my coverage to reduce my residence insurance rates? Be sure to talk to your insurance coverage agent regarding any updates made as well as if it can mean a lower rate (cheap auto insurance).

insurance companies car insurance insurance company

insurance companies car insurance insurance company

This article takes an appearance at which of the following influences