Are there ways to save money and still have the right quantity of protection? Below we information 5 types of protections as well as offer a few situations where you would benefit from having a non-required protection included to your plan along with some pointers to conserve some cash depending on your automobile as well as budget (auto).

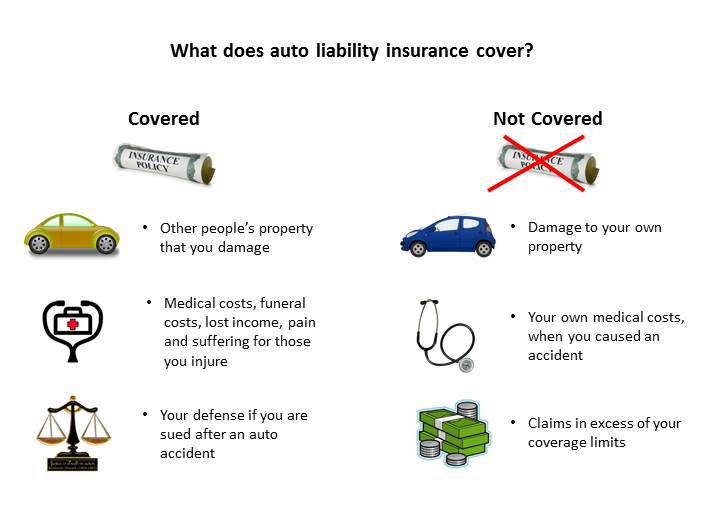

Responsibility insurance coverage will certainly cover the expense of repairing any kind of property damaged by a crash along with the clinical expenses from resulting injuries. Most states have a minimum demand for the quantity of responsibility insurance policy protection that drivers need to have - trucks. If you can afford it, nevertheless, it is usually a great concept to have liability insurance coverage that is above your state's minimum responsibility protection need, as it will certainly supply extra protection in case you are discovered liable for an accident, as you are responsible for any kind of claims that surpass your coverage's ceiling.

If there is a protected accident, accident coverage will certainly spend for the repair work to your auto. If your automobile is completed (where the expense to repair it exceeds the value of the lorry) in a crash, accident protection will pay the value of your cars and truck. If your automobile is older, it might not deserve lugging collision coverage on it, depending on the value.

Note: If you have a lienholder, this insurance coverage is needed. cheapest. What happens if something takes place to your automobile that is unrelated to a protected mishap - weather damage, you struck a deer, your auto is swiped - will your insurer cover the loss? Responsibility insurance as well as collision insurance coverage cover mishaps, yet not these situations.

Comprehensive coverage is just one of those points that is fantastic to have if it fits in your budget plan. Anti-theft and monitoring gadgets on cars and trucks can make this coverage a little a lot more budget-friendly, but bring this sort of insurance can be pricey, and also might not be needed, especially if your cars and truck is quickly replaceable.

What Does The Four Types Of Rental Car Insurance, Explained Do?

While Comprehensive insurance coverage may be something you don't need to purchase, Personal Injury Security (PIP) is something you should. The prices linked Great post to read from an accident can promptly build up, and in order to cover those expenses Individual Injury Defense is offered. With this coverage, your clinical costs in addition to those of your guests will certainly be paid, no matter that is at mistake for an accident.

While state regulations mandate that all drivers should be guaranteed, this is sadly not always the instance. Another issue that can develop is that while a motorist might have liability insurance coverage, lots of states have reasonably reduced minimum protection requirements that might not be enough to cover every one of the expenditures of an accident (affordable car insurance).

This is the kind of circumstance where Without insurance and Underinsured Vehicle driver Security would certainly aid with costs. Saving pointer: It's typically relatively inexpensive to include uninsured/underinsured vehicle driver security to your auto insurance coverage policy, specifically considering the quantity of security it supplies. This details in this e-newsletter is a summary only. It does not consist of all terms as well as problems and also exclusions of the solutions explained.

Protection might not be offered in all territories and undergoes financing evaluation and authorization. Resources:, www. insurance.com, www. carinsurance.com.

aids pay for medical as well as legal protection if an additional individual suffers physical injury in a crash where you are found to blame. aids spend for damage to an additional's residential or commercial property triggered while running your lorry. Once more, the quantity of required fundamental responsibility vehicle insurance varies by state. Am I called for to have greater than liability automobile insurance policy? You may be.

The Ultimate Guide To Types Of Car Insurance Coverage & Policies

State law claims that a police officer can not quit you exclusively to inspect if you have an insurance coverage card, but she or he can ask you for evidence of insurance during a stop for any various other legal infraction - insure. The initial penalty for falling short to maintain an insurance coverage card is $1,000 as well as suspension of driving benefits for one year or till the automobile proprietor reveals proof of insurance coverage.

Clinical repayments insurance coverage will pay the costs of individuals hurt in a crash despite fault. If your car was funded, usually your lending institution will certainly need you to lug crash and detailed protection. It is feasible to reduce your accident and also detailed premiums by increasing your deductibles. If you have an older vehicle, you can opt to bypass the crash as well as thorough protections completely.

You might wish to make a worksheet to assist you monitor the auto insurance quotes you obtain from different companies (liability). Numerous firms supply price cuts for bundling automobile and also home policies. Also, it is a great concept to track the discounts used by each business. If you have two or more vehicles and have all your automobile insurance with one firm, you are commonly qualified for a price cut under a "multi-car" strategy.

Generally, it is more affordable for young motorists to be included on their moms and dads plan than to have one on their very own. Young chauffeurs likewise can obtain good-student discounts with some companies. Pay your insurance coverage in a prompt way. If you are cancelled for non-payment of premium, it will be more challenging to locate a firm ready to cover you.

While it is essential to maintain the price of vehicle insurance coverage low, rate must not be the only consideration when you are looking for insurance coverage. As the claiming goes, you get what you pay for. In enhancement to contrasting costs, it is an excellent concept to contrast the monetary strength of a business, its track record for service, specific coverages, discounts and other benefits they offer.

Rumored Buzz on Your Guide To Understanding Auto Insurance In The ... - Nh.gov

If you have difficulty obtaining the info from the business itself, you might want to hesitate about getting from them. If you are associated with an accident and have an insurance claim, there are particular things that you must do: Call the police even if it is a mishap where the authorities do not usually react.

Alert your insurance coverage representative or business as quickly as possible. Get the names and also addresses of all witnesses and also people entailed in the accident.

If you have a loss, notify your firm promptly. Make duplicates of the finished kinds to keep on your own. After the business is informed of your claim, they must send you any kind of required forms to verify your case. The claim must be paid without delay after the business has actually obtained sufficient proof of loss (insurance companies).

Obligation is the most vital sort of cars and truck insurance coverage. trucks. Yet what does responsibility insurance coverage cover? How does it function? And also just how much of it do you need, anyhow? We'll travel through the response to all these questionsplus how much liability insurance expenses in your state. So bend up, as well as allow's begin! What Is Obligation Insurance? Obligation insurance is the most crucial type of vehicle insurance.

Travis gets in a cars and truck accident that's found to be his mistake. He does have obligation insurance policy.

5 Simple Techniques For What Is Liability Car Insurance Coverage - Belairdirect

What Does Liability Insurance Policy Not Cover? If your automobile is trashed or you obtained whiplash, your obligation insurance policy won't cover your fixing or clinical costs. Liability Insurance Protection Limits Below's something else you need to understand regarding liability insurance policy: It won't cover every solitary cost from currently till forever.

The protection limitation is the maximum amount the insurance coverage company will certainly pay after you pay your insurance deductible. Anything over the coverage restriction, you need to pay of pocket. There are two sorts of coverage restrictions for liability automobile insurance. Split Protection Boundary The majority of responsibility policies have different (aka split) insurance coverage limits for every kind of damage.

Insurance providers made the physical injury per mishap limitwhich is the 2nd number in your policy. That suggests the insurance company will certainly pay for injuries to the various other motorist as well as their guests up to $50,000.

Her physical injury obligation will cover all the medical expenses. Because her building damage restriction is $15,000, she still has to pay $5,000 to repair the various other driver's cars and truck.

The insurance provider would use that $90,000 to cover any kind of liability costs for the wreckno matter if they were injuries or building damages. Single protection limits offer you a lot more flexibility when paying for damages, so it can be worth asking your insurance policy agent regarding the costs of switching over to this sort of auto liability policy - insurance companies.

Top Guidelines Of What Is Liability Car Insurance? - Auto - Us News & World ...

which Tammy's insurance coverage additionally covers - risks. Overall costs for Tammy to pay: $0. Although her accident was way worse than Jake's, her insurance will cover the costsso she can focus on replacing her own vehicle as well as recovery from her very own injuries. See why it's so crucial to have all that coverage? Okay, we've drilled on the relevance of having lots of obligation protection.

(Seriously, it can include as little as $5 a month to your insurance policy. And also that $5 currently can conserve you 10s of thousands later on. That's worth it!) How to Update Your Obligation Insurance coverage Obtaining the advised responsibility insurance coverage is extremely very easy: Simply talk with one of our Backed Neighborhood Suppliers (ELPs).

They can even look for other coverages you might require, like umbrella or collision insurance coverage. car insurance. All set to collaborate with a vehicle insurance coverage representative you can trust? Get begun here..

When asking for rate quotations, it is important that you give the exact same information to every agent or business. The representative will generally ask for the adhering to details: description of your automobile, its use, your vehicle driver's certificate number, the variety of vehicle drivers in your household, as well as the protections and also limits you desire (cheaper auto insurance).

You will certainly be asked to answer several questions about yourself, where you live, your preferred level of protection, and your automobile or house. Responding to these inquiries to the most effective of your capability should result in a much better cost quote. perks. Where to Store, Check online, the newspaper and yellow pages of the telephone directory site for firms as well as agents in your area.

The Best Strategy To Use For What Is Liability Car Insurance? - Policygenius

In certain, ask them what kind of insurance claim service they have obtained from the companies they suggest. For Your Defense, When you have chosen the insurance policy protections you require and an insurance representative or company, there are steps you can take to make certain you obtain your cash's worth.

It is unlawful for unlicensed insurance firms to offer insurance as well as, if you purchase from an unlicensed insurance company, you have no assurance that the protection you pay for will certainly ever be recognized. Read Your Policy Meticulously, You need to realize that a car insurance policy is a legal agreement. It is composed so your rights and also obligations, along with those of the insurance company, are clearly stated (laws).